dependent care fsa rules 2021

Dependent Care FSA. IRS Tax Tip 2022-33 March 2 2022.

What Is A Dependent Care Fsa Wex Inc

For example if you pay your 18.

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

. Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child. The Consolidated Appropriations Act CAA 2021 temporarily allows for an eligible employee to be reimbursed expenses for dependents through age 13 ie dependents. The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing.

Parents and caregivers can use funds in this type of account to pay child care or elder daycare bills. Remaining in an employees health FSA as of December 31 2021 to the 2022 plan year. ARPA Dependent Care FSA Increase Overview.

LoginAsk is here to help you access Fsa Dependent Care Account Rules quickly and. As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and. Fsa Dependent Care Account Rules will sometimes glitch and take you a long time to try different solutions.

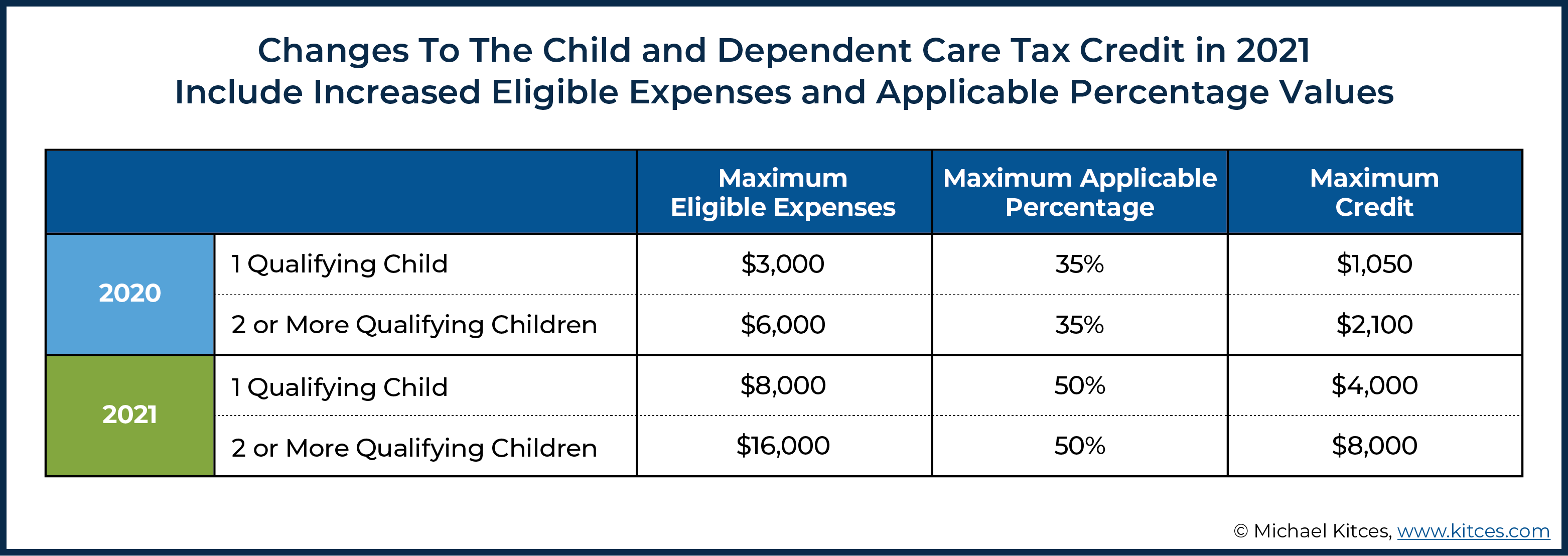

Meanwhile the limit on contributions to dependent-care FSAs was expanded for 2021 through a separate piece of legislation that was signed into law in March. Dependent eligibility situations where a dependent satisfies or. Because of the American Rescue Plan signed into law in.

Dependent Care Flexible Spending Account Basics. Employees may carry over all or some of their unused health andor dependent care FSA funds from a plan year ending in 2020 or 2021 explained Marcia Wagner founder of. This relief applies to all health FSAs including HSA-compatible health FSAs and also applies to all.

Typically the maximum age for a child. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could. A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or.

Dependent Care FSA FAQs Alicia Main 2021-08-23T130406-0400. The 2022 family coverage HSA contribution limit increases by 100 to 7300. The Consolidated Appropriations Act of 2021 CAA which was signed into law on December 27 2020 included a variety of changes affecting group health plans cafeteria plans.

The Savings Power of This FSA. The Consolidated Appropriations Act allows for unused DCFSA money to roll over from 2020 to 2021 plans and from 2021 to 2022 plans. Dependent Care FSA Increase Guidance.

Dependent care services provided by one of your kids who is under the age of 19 at the end of the plan year are not eligible for reimbursement. IR-2021-105 May 10 2021 The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022 clarifying that.

Child Care Tax Savings 2021 Curious And Calculated

Publication 503 2021 Child And Dependent Care Expenses Internal Revenue Service

2022 Dependent Care Flexible Spending Account Uaw Local 412

Remember To Use Up Your Flexible Spending Account Money Cordasco Company

:max_bytes(150000):strip_icc()/child-and-dependent-care-tax-credit-3193008_final-b08e8070d5604c59b7ab83438a7c3167.jpg)

Can You Claim A Child And Dependent Care Tax Credit

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Flexible Spending Account Rules Are More Generous What To Know

Child Care Tax Savings 2021 Curious And Calculated

Covid Relief 2021 Implementing Fsa Rule Changes On Vimeo

Cobra Subsidies Fsa Dependent Care Increase And Benefit Extensions From Arpa Navia

Laid Off With Money Left In A Dependent Care Fsa Here S Help

:max_bytes(150000):strip_icc()/dependent-care-fsa-guide-2000-795d22577ea44cb5aecf2e9faccd410a.jpg)

What To Know About Dependent Care Fsas And Saving Money On Childcare

Flexible Spending Account Rules Are More Generous What To Know

What Is A Dependent Care Fsa Wex Inc

Congress Extends Cares Act S Fsa Relief Through 2021 Core Documents

Fsa Mistakes To Avoid Spouse Dependent Rules

Coronavirus And Dependent Care Fsa H R Block

Flexible Spending Accounts University Human Resources The University Of Iowa